Disney's Growth Potential - Buy Now?

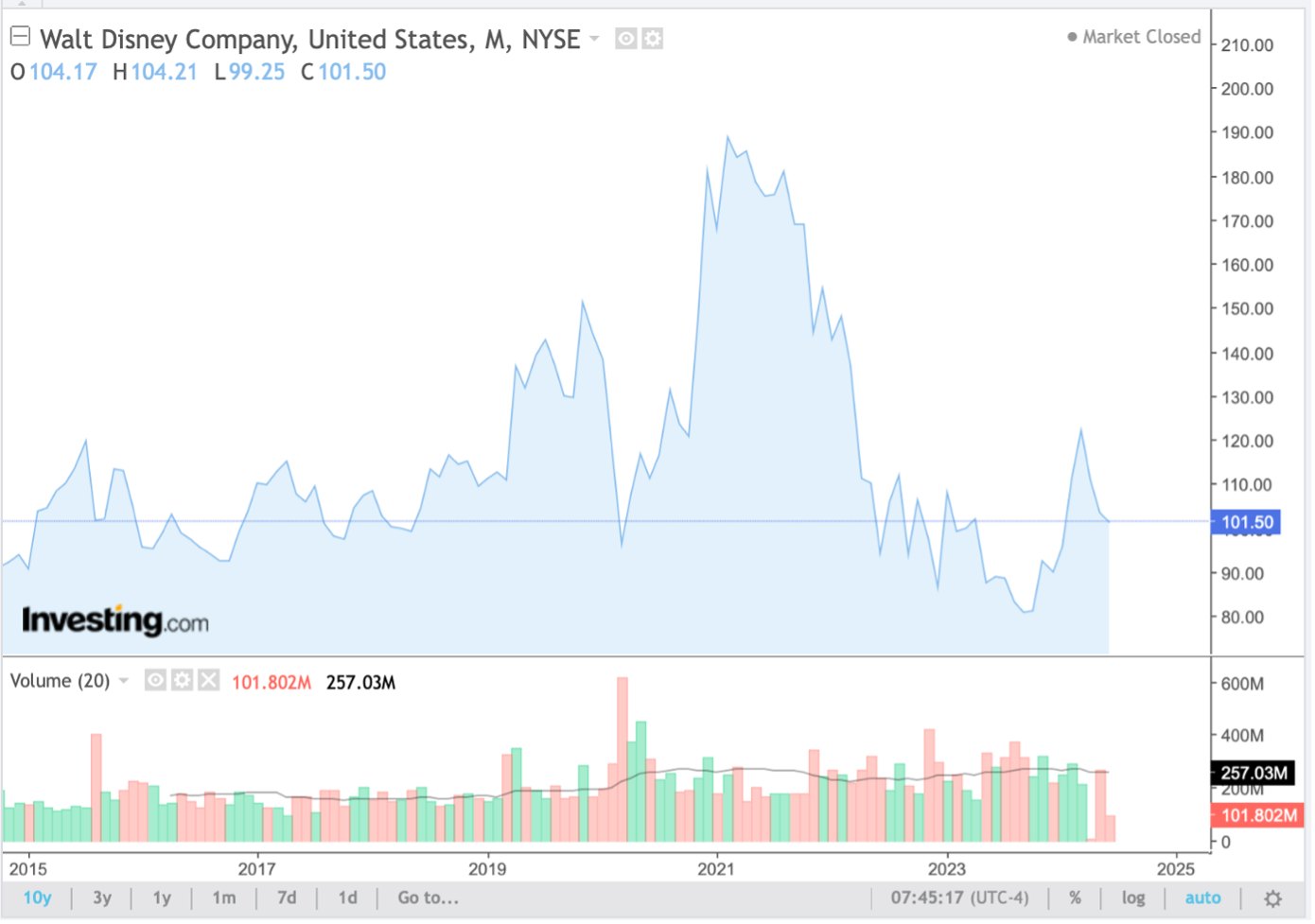

The Walt Disney Company (NYSE: DIS) has encountered a challenging three years, with rising costs, waning interest in theatrical films, the ongoing decline of cable TV, and an activist investor's influence. Consequently, Disney shares have halved since their early 2021 peak.* Despite these setbacks, experienced investors see such dips as potential buying opportunities, and Disney's current situation is no exception.

Source: Investing.com

The company’s turnaround is progressing, addressing four major challenges. First, the proxy battle with Nelson Peltz is over. Peltz, who criticized Disney's performance and management, has sold his stake, allowing Disney's leadership to focus on its own strategic plans.

Second, Disney’s streaming business is now profitable. In Q1 2024, Disney+ and Hulu turned $5.6 billion in revenue into $47 million in operating income. While this is modest, it marks significant progress and demonstrates the potential for future growth. [1]

Third, Disney is planning to launch a streaming version of ESPN by 2025. This move is crucial as cable TV's decline has impacted ESPN's growth. With a significant portion of consumers being sports fans, a standalone streaming service could prove more lucrative than traditional cable.

Fourth, analysts believe Disney stock is undervalued. Of the 30 analysts covering Disney, 19 rate it as a strong buy, with a consensus price target 25% above the current price. This positive outlook suggests that Disney’s potential is recognized despite current challenges. [2]

While risks remain, including uncertainties in theatrical movie attendance and theme park performance, Disney’s strategic moves and robust brand position present a compelling case for investment. The company is addressing its challenges and leveraging its strengths, making it a potential buy for investors looking for long-term growth. [3]

* Past performance is no guarantee of future results.

This text constitutes marketing communication. It is not any form of investment advice or investment research or an offer for any transactions in financial instrument. Its content does not take into consideration individual circumstances of the readers, their experience or financial situation. The past performance is not a guarantee or prediction of future results.