Behind every successful investor lies knowledge. Investago stands by your side to help you achieve the best investment results.

We are no newcomers to the market. Investago is a trading brand of Wonderinterest Trading LTD, which has been operating since 2016. Our experts are experienced and can provide you with advice tailored to your knowledge, requirements, and the goals you want to achieve in the world of investments.

Investago is a registered brand of Wonderinterest Trading Ltd, registration number HE 332830. Wonderinterest Trading Ltd is a Cyprus Investment Firm (CIF) supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under licence no. 307/16.

The deposit in the trading account you open with us is protected by the Investor Compensation Fund up to 20,000 EUR.

We are no newcomers to the financial markets. We have been providing our services to clients since 2016.

Maintaining a trading account is completely free, as is registration, which takes just a few seconds.

Our customer support experts are here for you in your local language all five business days.

MetaTrader 5 is a powerful trading platform that offers state-of-the-art tools and technology. With its advanced features and intuitive interface, it’s an ideal partner regardless of your trading experience.

License and Regulation

Investago is a registered trademark of Wonderinterest Trading Ltd, a Cyprus Investment Firm (CIF), which is supervised and regulated by the Cyprus Securities and Exchange Commission (CySEC) under CIF license no. 307/16 and registration number HE 332830.

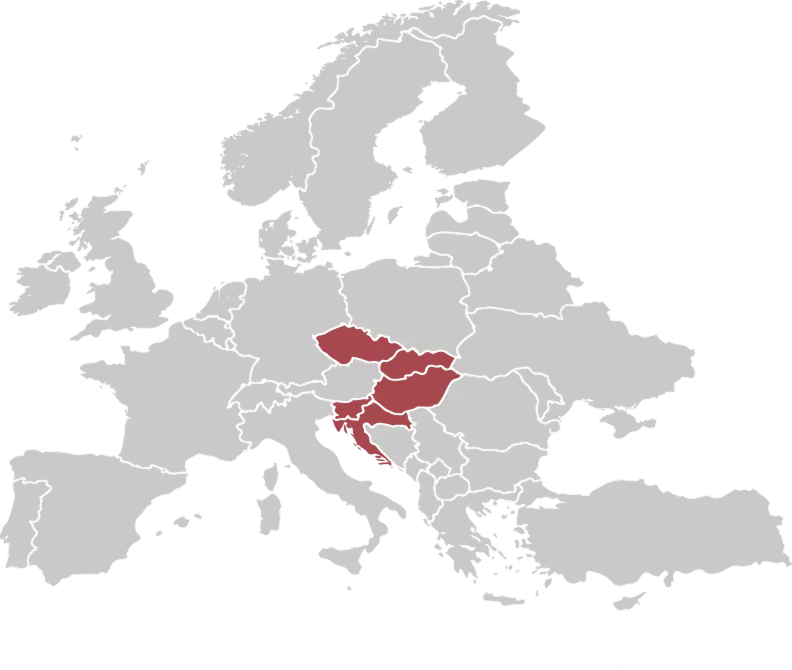

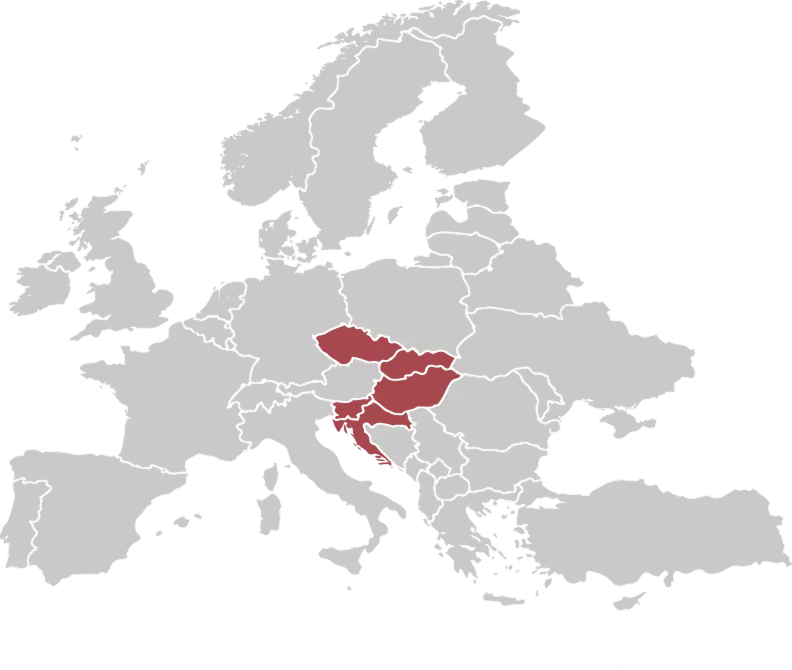

Investago provides the following investment services regarding financial matters in the member states of the EU.

Investago provides investment services through a tied agent: Wonderinterest Trading s.r.o., which is subject to the supervision of the Czech National Bank (www.cnb.cz) with its registered office at Na Příkopě 28, Prague 115 03. Extract from the Commercial Register.

I. Investment Services

Reception and transmission of orders in relation to one or more Financial Instruments.

Provision of investment advice.

Execution of orders on behalf of clients.

II. Ancillary Services

Safekeeping and administration of financial instruments, including custody and related services.

Foreign exchange services, where these are connected to the provision of investment services.

Investment research and financial analysis or other similar forms.

III. Financial Instruments

Units in collective investment undertakings

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to securities, currencies, interest rates or other derivative instruments, financial indices or financial measures, which may be settled physically or in cash.

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled in cash or may be settled in cash at the option of one of the parties (other than by reason of default or another termination event).

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled physically, provided that they are traded on a regulated market or an MTF.

Options, futures, swaps, forward rate agreements and any other derivative contracts relating to commodities that must be settled physically and are not mentioned in point 6 of Part III and are not for commercial purposes, which have the characteristics of other derivative financial instruments, taking into account, among other things, whether they are cleared and settled through recognized clearing houses or are subject to regular margin calls.

Derivative instruments for the transfer of credit risk, such as financial contracts for differences.

Options, futures, swaps, forward rate agreements and any other derivative contracts related to climatic variables, freight rates, emission allowances or inflation rates, as well as other official economic statistics, that must be settled in cash or may be settled in cash at the option of one of the contracting parties (other than by reason of default or another termination event), as well as any other derivative contracts relating to assets, rights, obligations, indices and measures not otherwise mentioned in this section, that have the characteristics of other derivative financial instruments, taking into account, among other things, whether they are traded on a regulated market or MTF, cleared and settled, or subject to regular margin calls.

Trading Conditions

Order Types: INVESTAGO offers clients the following order types. Where possible, you may choose from: Buy, Sell, Buy Limit, Sell Limit, Buy Stop, Sell Stop, Take Profit, Stop Loss, Trailing Stop.

Trading Hours: Trading hours for Forex, commodities, indices, and stocks can be found here.

Instruments: A complete list of available trading instruments, along with their underlying assets and the exchanges where they are actively traded, can be found here.

Rollovers: Please note that in the case of a rollover, the Swap will be automatically credited or debited to your account. A table of dates of the rollovers and expirations can be found here.

Demo Account: The demo account is limited to 30 days. After that, you can switch to a live account.

Account Types: INVESTAGO offers its clients:

Floating (typical) spreads; market conditions may cause spreads to widen or narrow beyond typical levels

A wide range of instruments (Forex, precious metals, CFDs)

Standard trading lots

Spreads from 3 pips on EUR/USD

Leverage up to 1:30

Margin requirements for opening new positions are calculated based on the reduced leverage.

Leverage Limits: According to the CySEC announcement published on 28 March 2018, following ESMA’s press release on CFD product intervention measures, leverage limits for retail clients at position opening should be 1:30.

Note: The default leverage offered during the account opening process is set at a maximum of 1:30.

Swaps: Charged at the end of each business day. Triple on Wednesdays. Swap points for MT5 can be found here.

Margin Call: When margin reaches 100%, the platform notifies clients that automatic liquidation of their positions is approaching. Clients receive notifications only if they are logged in. Therefore, clients are advised to log in regularly and monitor their assets and notifications. When margin drops below 50%, the platform automatically closes positions.

Negative Balance Protection: The company guarantees that the maximum loss on client accounts never exceeds available funds on those accounts. Balances can never go negative, so even during strong market volatility, you will never lose more than your deposit. Professional risk management ensures clients are not exposed to unnecessary risks.

Dividend Adjustments: Equity and cash indices reflect corporate actions. If you hold a long position in the relevant stocks, you are entitled to a dividend payment. If you hold a short position, the dividend amount will be deducted. For dividend adjustments related to shares held at the end of the day before the ex-dividend day, the company applies dividend settlement. For CFD transactions on individual stocks:

Clients holding long equity CFD positions will receive dividend credits based on ex-dividend settlement.

Clients holding short equity CFD positions will have dividends debited accordingly.

Dividends may be subject to tax. The company may terminate or modify dividend adjustments due to changes in legislation, regulatory systems, tax rates, or withholding tax requirements.

Management Fee: Trading in physical shares is limited to buy-only. An annual management fee of 5% applies, charged daily in the form of a swap at the end of each trading day. On Wednesdays, the fee is applied at three times the standard rate.

Maintenance Fee: If the Client Account is inactive (i.e. there is no trading, withdrawals, or deposits), the following monthly maintenance fees apply based on the period of inactivity:

Up to 6 months of inactivity: No maintenance fee

From 6 to 12 months of inactivity: 39 USD per month

More than 12 months of inactivity: 79 USD per month

If the client has no funds in their trading account, the inactivity fee is not charged.

FTT: All transactions on Italian CFDs and ITA40 are subject to the Financial Transaction Tax (FTT). The tax is charged as a fixed fee based on the nominal value of the transaction:

Up to EUR 2,500: 0.25 EUR

EUR 2,500 – 5,000: 0.50 EUR

EUR 5,000 – 10,000: 1 EUR

EUR 10,000 – 50,000: 5 EUR

EUR 50,000 – 100,000: 10 EUR

EUR 100,000 – 500,000: 50 EUR

EUR 500,000 – 1,000,000: 100 EUR

Above EUR 1,000,000: 200 EUR

DOCUMENTS FOR REGISTRATION

As a fully licensed and regulated investment company, we must comply with strict standards and guidelines regarding the verification of all potential customers.

Therefore, when opening an account and using our services, we require our clients to provide proof of identity with a passport, ID card, or driver’s license.

Below you will find a list of documents required to activate and verify your account.

PERSONAL ACCOUNT

1. POI – Proof of Identity

The identity document must be government-issued, valid, and all four corners must be clearly visible.

· Passport

· ID card – both sides

· Driver’s license – both sides

The scanned copy should include the following details:

· Photo and full name

· Date of birth

· Signature

· Nationality

· Issuing authority

· Expiry date (if missing, the issue date must be visible)

· Document number (ID or passport number)

· MRZ number (if applicable)

*The address on the ID card does not have to match the address provided during registration.

Notice: According to Law 188(I)/2007, as amended, on the prevention of money laundering and terrorist financing, paragraph 66(2):

“Persons engaged in financial or other business activities are prohibited from opening or maintaining anonymous or numbered accounts or accounts under names other than those stated in official identity documents.”

Therefore, please ensure that your registration details exactly match those in your identification and residence documents.

2. POR – Proof of Residence

To complete the residence verification process, please provide a copy of a document showing your address. This copy should state your usual residence, which may differ from your permanent residence address.

The copy should contain the following details:

· Full name

· Residential address

· Date of issue

· Name and details of the issuing entity

The following documents are acceptable as valid proof of residence:

· Bank account statement showing name and issue date

· Utility bill – gas, electricity, water, internet, etc.

· Document from a government authority or official

· Government-issued residence certificate

Any of the above documents, not older than 6 months, showing your name and current residential address, is acceptable.

Please note that the following documents will not be accepted:

· Insurance documents (life, car, etc.)

· Mobile phone bills

· Handwritten documents

CORPORATE ACCOUNT

Below you can find a list of documents required for the approval of a company trading account:

1. CAO Questionnaire: issued by our company.

2. BoD Board Resolutions: resolution of the company’s board of directors on the opening of the account and granting authorization to those who will operate it – issued by our company, must be completed in English.

3. BoD Power of Attorney: authorizing the Representative to act on behalf of the Client – issued by our company.

4. CRS Self-Certification.

5. FATCA Self-Certification.

6. Limited Power of Attorney.

7. Recent copy of the company’s Certificate of Incorporation in English or a recent copy of the Certificate of Incorporation and a notarized translation from the original language into English – if this document is not available, the following documents are required:

· Certificate of Incorporation;

· Recent (not older than 6 months) Certificate of Good Standing;

· Certificate of Registered Office – a company bank account statement may also be accepted if it includes the company’s address;

· Certificate of Directors and Secretary;

· Certificate of Shareholders;

· Memorandum and Articles of Association;

· Financial statement for the previous year.

8. Recent company bank statement from which the client will deposit funds.

9. If the registered shareholders act as the company’s owners, a copy of the agreement/contract concluded between the appointed shareholder and the beneficial owner must be provided, under which the registration of shares in the name of the appointed shareholder on behalf of the beneficial owner of the company was agreed.

10. For each director, registered shareholder (if there are multiple shareholders with small holdings, only those owning at least 25% of the shares) and/or beneficial owner of the company who is a natural person, according to the Certificate of Directors, the following documents are required:

· Proof of identity;

· Proof of current residence.

11. For each director or registered shareholder who is a legal entity, according to the Certificate of Directors, the following documents are required:

· Certificate of Incorporation;

· Recent (not older than 6 months) Certificate of Good Standing;

· Certificate of Registered Office;

· Certificate of Directors and Secretary;

· Certificate of Shareholders;

· Memorandum and Articles of Association.

12. In the case of Representatives authorized to open and/or operate the Client’s account, for each Representative the following documents must also be submitted:

· Proof of identity;

· Proof of residence.

13. Certificate of Good Standing of the client issued by the Registrar of Companies.

14. LEI code confirmation.

Notice: According to the applicable regulatory framework (General Data Protection Regulation (EU) 2016/679 and Directive 2014/65/EU – MiFID II), the company shall retain records containing client personal data, business information, account opening documents, communications, and everything else related to the client for at least five (5) years after the termination of the business relationship with the client. Upon request of the competent authority (CySEC), unless otherwise provided by national legislation, for an additional period of up to seven (7) years.

ONLINE PAYMENTS

By implementing a compliance procedure related to online payments, we aim to ensure the security of our clients and transactions in the financial environment.

To meet the highest standards for deposits and withdrawals, we require the following for the selected payment method:

1) Copy of a credit/debit card

· Front side: Your first and last name, expiry date, first 4 and last 4 digits of the payment card.

· Back side: Your signature.

For your security, please cover the middle 8 digits on the front side of the credit card and the security code (CVV) on the back side.

2) Confirmation of the payment account including

· Your full name

· Account number

· Date of transfer

· Exact amount of the transfer

PLEASE NOTE THAT THIRD-PARTY OR CASH DEPOSITS ARE NOT ALLOWED.

All information related to your credit/debit card is processed with the aim of ensuring privacy and security. In addition, deposits and withdrawals are processed only through licensed and regulated payment providers.

Client activation procedure

Please note that your account will be ready for trading once all required documents are provided and approved. If your account balance is zero, you will not be able to trade.

Other documents

If you do not have proof of residence in your name, we will ask you to provide the following documents from a close family member living with you in the same household (mother, father, wife, or husband):

· POI – Proof of identity of the client

· POR – Proof of residence of the client

· In the case of “mother/father,” we require the client’s birth certificate.

· In the case of “wife/husband,” we require the marriage certificate.

-

You can find the 2018 Risk Disclosure Report here.

-

You can find the 2019 Risk Disclosure Report here.

-

You can find the 2020 Risk Disclosure Report here.

-

You can find the 2021 Risk Disclosure Report here.

-

You can find the 2022 Risk Disclosure Report here.

-

You can find the 2023 Risk Disclosure Report here.

-

You can find the 2024 Risk Disclosure Report here.