JP MORGAN SHARES FALL DESPITE PROMISING QUARTER

Even though JPMorgan posted a strong performance in the latest quarter, it expects lower net interest income than the market. Shares are down more than 2%* in the pre-market. JPMorgan's profit for the three months ended Dec. 31 rose to $11 billion, or $3.57 a share, compared with $1.3 billion, or 45 cents a share, in the previous quarter.

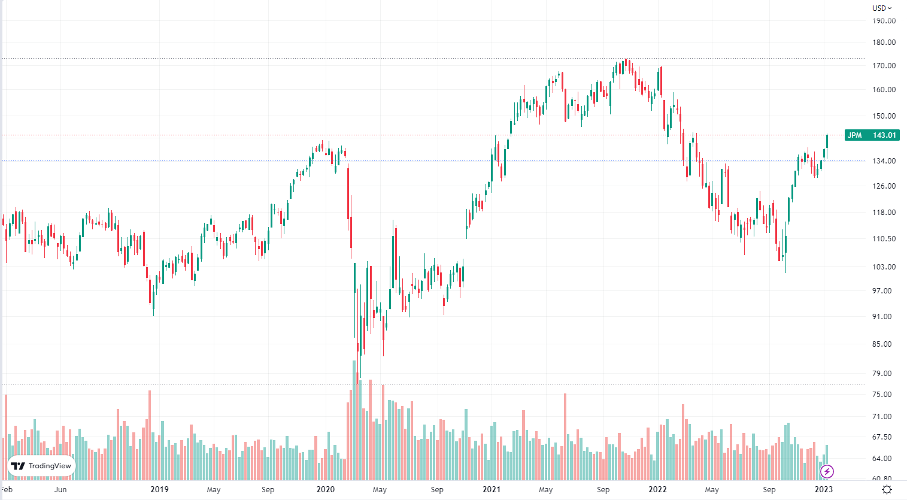

JP Morgan Chase & Co. stock performance over 5 years. Source: tradingview.com

We can see comparison to the same quarter last year, which recorded just six hundred million dollars, or 24 cents a share. The results include the impact on earnings of $914 million from the sale of Visa shares. Net interest income also rose significantly in the latest quarter both year-over-year (from $6.6 billion last year) and quarter-over-quarter (from $2.7 billion in 3Q22) to $20.3 billion.

CEO Jamie Dimon said that "the US economy is currently strong, consumers are still spending surplus money and businesses are healthy", but we still don't know the ultimate impact of the coming problems. The investment banking industry also weakened in the past quarter as corporate executives braced for a possible recession and were reluctant to spend on mergers and acquisitions. Revenues in this segment fell by 57%. Trading revenues, on the other hand, rose, benefiting from market volatility. Investors reallocated their investments to better adapt to the high interest rate environment. While fixed income trading revenue rose 12%, equity trading revenue remained relatively flat, the bank said.

JPMorgan also set aside $1.4 billion in loan loss reserves. The bank's capital adequacy ratio is at 13.2%. Last year, JPMorgan decided to temporarily suspend its share buybacks to quickly meet higher capital requirements from regulators.

Sources: Kurzy, Reuters, Bloomberg, JP Morgan

* Past performance is no guarantee of future results