CFD ETF

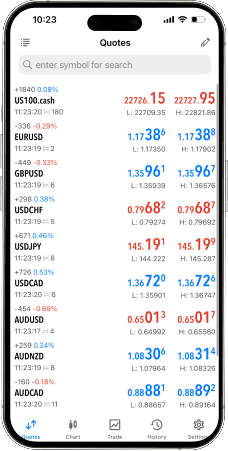

Instruments

CFD ETFs allow investors to trade funds focused on selected sectors or groups of companies through a single instrument. They provide diversification, meaning the spreading of risk across multiple stocks, while also enabling investors to profit from the movement of an entire sector without having to track individual securities.

Trading is risky and your entire investment may be at risk.

Warning: Investago reserves the right to widen the spread at its sole discretion, reduce leverage, set a maximum order limit, and limit the client's overall exposure. InvestaGO also reserves the right to increase margin requirements in situations where market conditions require it. Please read the Trading Account Agreement carefully.

* Trading complex products with higher leverage involves a high level of risk and may lead to the loss of all or part of your invested capital.

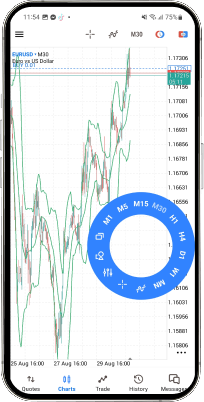

** Right after you open your trading position, the spread – which is the difference between the current ask and bid price – will be deducted from your account.

*** A minimum commission applies, depending on your account currency (5 EUR / 5 USD / 125 Kč / 4000 HUF / 20 PLN). Upon opening and closing a trading position, a commission will be deducted from your account.

Frequently Asked Questions (FAQ)

It is completely normal that before you start investing with us, you want practical advice on how to open an account or whether we have offices in the selected country. We believe you will find all the answers you need in the text below.