Can Threads Spin Meta's Stock Further?

Meta Platforms' newly launched app, Threads, is generating significant buzz as a potential competitor to Elon Musk's Twitter. In its first few hours, Threads attracted over 30 million users, a figure expected to rise given the app's integration with Instagram. However, for Threads to positively impact Meta's stock, which has already risen by over 132% this year, two things need to occur, according to Morningstar's senior equity analyst, Ali Mogharabi.*

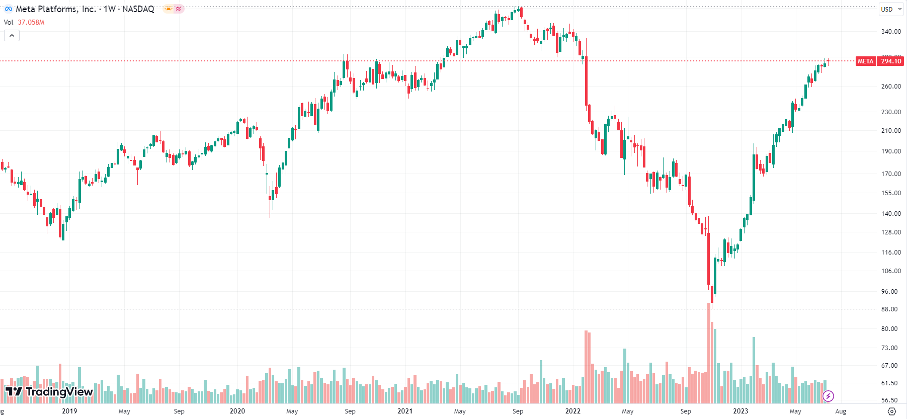

Performance of Meta Platforms, Inc. over 5 years. Source: tradingview.com

It must attract a user base to rival Twitter's, and it needs to promote daily engagement akin to Instagram and Facebook. The growth of Threads' user base is already impressive, but Meta needs to make the platform engaging enough for daily use. If Meta plans to monetize Threads with ads, advertisers will want to see user growth comparable to Twitter's 330 million monthly active users. Furthermore, user engagement on Threads needs to match that of Instagram and Facebook, Meta's other key platforms. Advertisers will be interested in a high daily to monthly user ratio. If Threads can establish itself as a key product for Meta, it would enhance the company's entire portfolio of apps' attractiveness. Brands could streamline their advertising purchases by targeting a single ecosystem's user base. However, the challenge lies in converting loyal Twitter users into regular Threads users without overwhelming them with ads. [1]

* Past performance is no guarantee of future results.

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or based on the current economic environment which is subject to change. Such statements are not guaranteeing of future performance. They involve risks and other uncertainties which are difficult to predict. Results could differ materially from those expressed or implied in any forward-looking statements.