How Airbnb recovered from the pandemic

Airbnb offers unique, affordable accommodation anywhere in the world, bringing travellers together under one online roof. It offers more than 6 million different places to stay in 220 countries. Airbnb provides an alternative substitute for more expensive hotels while making travel more interesting. It also provides reviews and ratings, secure payments and 24/7 customer support.

Airbnb was founded in 2008 by Briac Chesky, Joe Gebbia and Nathan Blecharczyk. The original idea was to rent out air mattresses in their apartment during a design conference in San Francisco. That's where their original name AirBed and Breakfast came from, which was later shortened. In addition to regular rooms, some of the most popular offerings include treehouses, castles, and private islands. At the beginning, it did not seem that the system could work, mainly due to low demand and lack of interest from investors. Eventually, the investment of the investors was obtained, and the founders were able to revolutionize travel and tourist accommodation. The company went public on December 10, 2020, and achieved a 112 percent increase in shares on the first trading day. Under the ticker ABNB. The subscription price of the share was $68 and after the start of trading, it climbed to $149.*

A thorn in the side of hotels

Over the years of its existence, it has faced various crises, some cities wanted to suppress Airbnb, as it had a significant impact on local communities. Understandably, Airbnb also came into conflict with hotels and real estate brokers, as it had a major influence on their operations. French hotels, which considered Airbnb unfair competition, demanded that it have a professional estate agent's licence. This request was rejected, although, according to them, it significantly increases the price of real estate. The biggest blow to the company, however, was the COVID-19 pandemic.

Stopping global travel

Before the pandemic, the company was experiencing rapid growth and success, but after the restrictions were put in place, travel and accommodation options fell rapidly. Fortunately, Airbnb has been innovative. It has introduced its own restrictions to keep the platform attractive, such as the ability to cancel a booking with a full refund between 14 March 2020 and 31 October 2020, or virtual experiences that have allowed hosts to offer online cooking classes, guided tours and fitness workouts. Although it saw a drop in bookings and was forced to lay off 25% of its workforce, namely 1,900 employees, there was a recovery in demand as soon as the restrictions were eased.

Market recovery

The post-pandemic releases in 2021 meant a high increase in profits for the company, and so in the third quarter, revenues grew 67% year-on-year to $2.24 billion. The profit was $834 million. In the fourth quarter, it was 55 million and year-on-year sales grew 78%. This brought Airbnb to pre-pandemic levels.

Airbnb harnesses the potential of modern technologies

The company is well positioned to continue to grow and evolve in response to new travel trends and opportunities. It expects headcount growth of between 2% and 4% in 2023, compared to 11% growth the previous year. It is relying on the gig economy, which is characterised by a preponderance of short-term contracts or freelance work as opposed to permanent jobs.

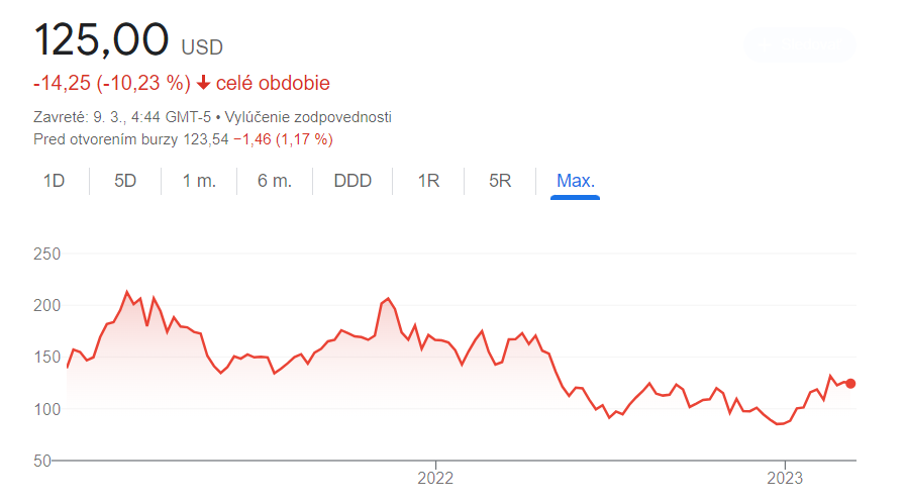

The company has recovered well from the pandemic and the restrictions associated with it, posting a record Q4 in 2022, when its revenue grew 24% year-on-year to $1.9 billion thanks to an increase in stays and experiences. Cross-border travel increased by 49% year-on-year in Q4 2022, with the Asia-Pacific region experiencing the strongest growth globally. The total number of offers on Airbnb grew to 6.6 million as the platform added 900,000 active offers year-on-year. The cancellation of refunds for bookings due to covid also contributed to the profit. As for the stock's development, although it has been in the red since its listing, we can see a recent recovery.

Airbnb's share performance since listing (Source: Google)

Interesting rebalancing of the portfolio

Despite several legal disputes, Airbnb has not suffered too significantly in 2022 compared to other highly valued technology platforms. It is currently looking into the possibility of crypto payments and the adoption of blockchain technology. The company's CEO Chesky believes that blockchain technology could mark another significant step towards growth. In the coming years, an increased interest in travel is expected, as pandemic restrictions are no longer so strict. The incorporation of cryptocurrencies and blockchain could have the potential and positive impact on stock value.

AirBnb in numbers

2011 – launched a mobile application that allows you to make reservations

2012 – surpassed 1 million nights booked and created Airbnb Experiences

2017 – Airbnb Plus service, vetted high-quality properties and Luxury Retreats platform

2019 – Airbnb went public, valued at $47 billion in IPO

2020 – The company introduced a global party ban and limited the number of guests to a maximum of 16

Matúš Mahút, analyst at InvestaGO

* Past performance is no guarantee of future results.