Tesla Fever: Individual Investors Drive Stock Rally and Record Inflows

Individual investors have shown unprecedented interest in Tesla, spending a net $13.6 billion on Tesla shares in 2023 alone, nearing the record sum of $17 billion for all of last year, according to Vanda Research. Tesla's stock price has jumped 61% this year, likely driven in part by the buying activity of individual investors.*

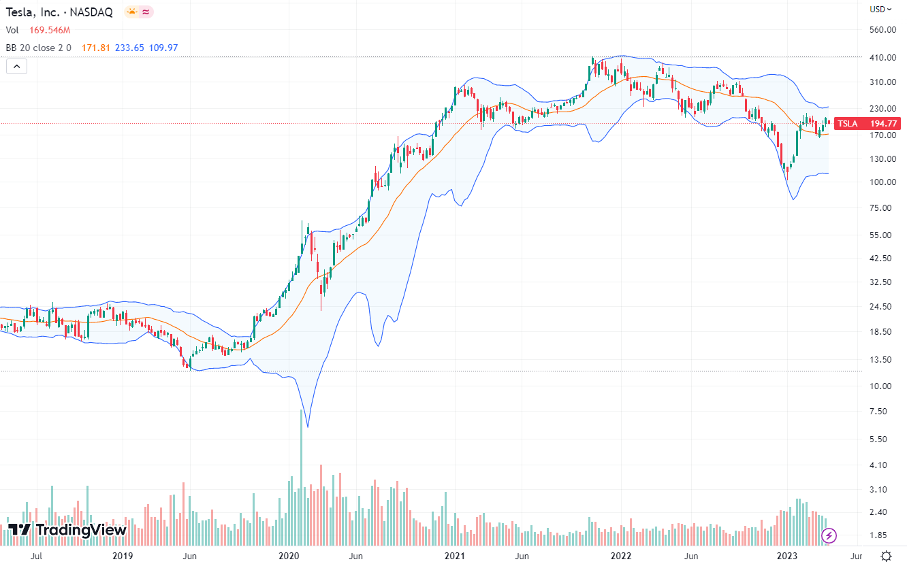

Performance of Tesla, Inc. stock over 5 years. Source: tradingview.com

As Tesla's investor day approached, the five-day moving average of individual investors' net one-day purchases reached around $460 million in late February, far outpacing the average for the next-most-popular security, the SPDR S&P 500 ETF, at just under $150 million. Tesla shares have recovered from the 5.9% drop following investor day, despite the lack of a new, less-costly vehicle announcement and the company's potential need to spend nearly $150 billion to achieve its long-term goal of becoming the world's largest carmaker by volume.*

Despite the volatility, Tesla remains popular among individual investors, with the proportion of accounts trading Tesla on online brokerage Webull Financial climbing to 18% in February from about 4% six months ago. Tesla also dominates the options market, with nine of the 10 most popular contracts involving expectations of the stock rising.

However, Tesla remains the most shorted stock in the U.S., although short interest has dropped to $15 billion from a peak of more than $51 billion in January 2021.

* Past performance is no guarantee of future results.