Apple breaks new frontier

On the last day of June, Apple managed to reach a market capitalisation of USD 3 trillion, becoming the first company in history to surpass this threshold. This achievement can be attributed to an event in August 2020, when it also became the first US company to reach a market capitalisation of USD 2 trillion.

Interestingly, at the beginning of 2022, Apple had already briefly surpassed the three-billion-dollar mark, but failed to close at that level. It finally succeeded a few days ago. Shares rose 2.31% to $193.97 on June 30, and market capitalization reached $3.05 trillion* on that historic day. Apple is the most valuable company in the world, renowned for its advanced smartphones and innovative devices that have found loyal customers in every corner of the planet. In second place is technology company Microsoft and third place is held by Saudi Arabian oil and gas giant Saudi Aramco. Alphabet, Amazon, Nvidia, Tesla, Berkshire Hathaway, Meta Platforms and TSMC round out the top ten.

Tough 2022 as a hurdle

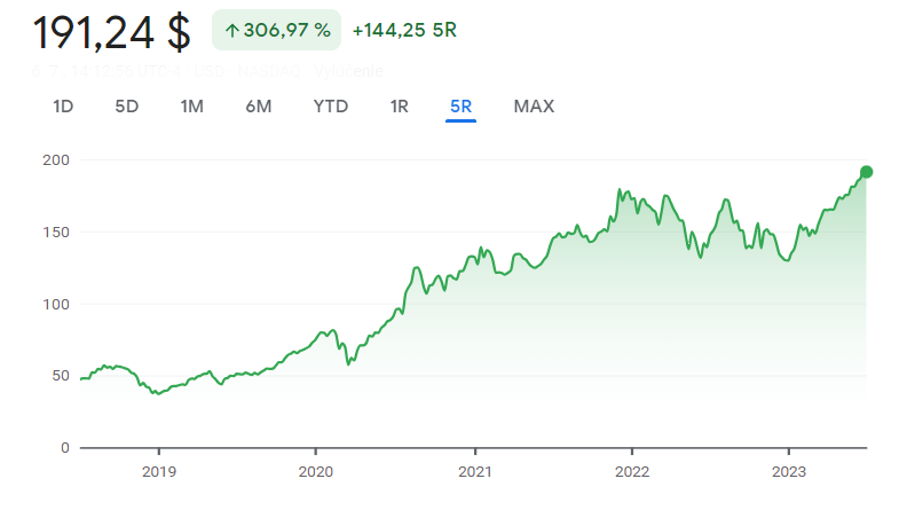

Apple could have reached this milestone sooner if it had managed to avoid a difficult 2022, when the tech sector suffered major losses due to a number of factors such as supply chain issues. By mid-2023, the stock price had risen 49%, increasing the company's market capitalization by more than $900 billion. Since the beginning of this year, they have risen by more than 52%, indicating favorable developments influenced by favorable contracts or the introduction of innovative products. Thanks to artificial intelligence, the technology sector has been able to recover quickly in recent months from the previous period.* Other giants such as Microsoft, Alphabet and Meta Platforms are also enjoying the integration of this revolutionary innovation, but Apple has made little mention of it, focusing its attention mainly on the Vision Pro mixed reality headset.

Apple's stock performance over the past five years (Source: Google)*

A history marked by revolutionary achievements

Founded on April 1, 1976, in Los Altos, California, the company has undergone many milestones since then. Steve Jobs, Steve Wozniak and Ronald Wayne were at the company's roots. In 2000, it fought for its five billion dollar market capitalization, which started a journey of groundbreaking inventions. Among the first was the iPod in 2001, which earned the company worldwide investor attention. The next revolution in the technology world came in 2007 when Apple introduced its iPhone, which featured a touchscreen, the Internet and leveraged the iPod's previous software, allowing users to have all these conveniences in one device. In 2010, it took advantage of the popularity of tablets and launched its iPad product. In 2015, it introduced the world to the iWatch followed by the AirPods, and in the run-up to the fall it still managed to release Macbooks with the M1 chip. This year will be defined by the aforementioned Vision Pro mixed reality headset and other enhancements to existing products. Apple has big plans for the future, and thanks to a broad fan base that is building an entire ecosystem of products bitten by Apple, it is well positioned to continue its current upward trend in share value[1].

Matúš Mahút, analyst at InvestaGO

* Past performance is no guarantee of future results

[1] Forward-looking statements are based on assumptions and current expectations, which may be inaccurate, or on the current economic environment, which may change. Such statements are not guarantees of future performance. They involve risks and other uncertainties that are difficult to predict. Results may differ materially from those expressed or implied by any forward-looking statements.